Pf Form 15g Pdf

- 15g Form Pdf For Pf

- Upload Form 15g Pdf Pf Withdrawal

- Pf Form 15g Pdf Download

- Pf Withdrawal Form 15g Pdf

- Pf Form 15g Pdf Download

New Form 15G & Form 15H Under the simplified procedure, a payee / an individual can submit the self-declaration either in paper form or electronically. The deductor (Example – Bank) will not deduct tax and will allot a Unique Identification Number (UIN) to all self-declarations in accordance with a well laid down procedure.

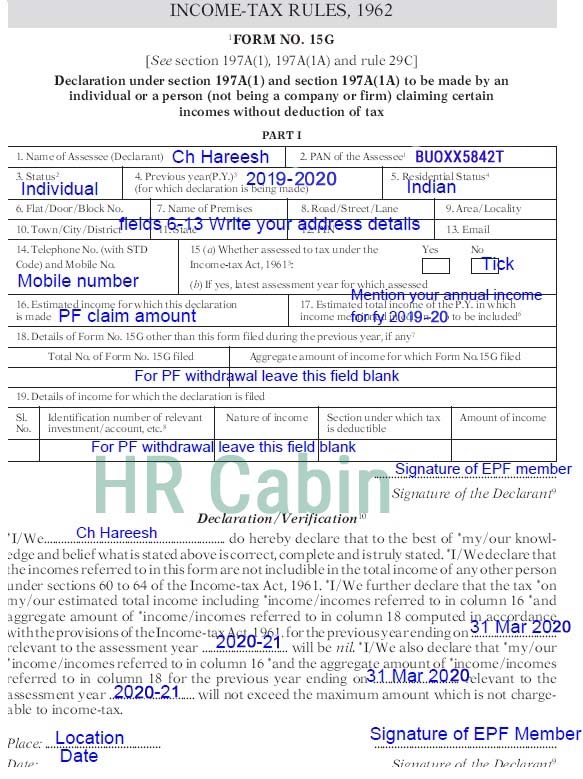

- Form 15G in Fillable Format. Form 15 G - Declaration under sub-sections (1) and (1A) of section 197A of the Income-Tax Act, 1961, to be made by an individual or a person (not being a company or a firm) claiming certain receipts without deduction of tax.

- EPF Form 15G – How to fill online for EPF withdrawal? Now you have understood the TDS rules applicable to EPF and also you came to know what is Form 15G or 15H. Let us move on and understand the process of how to fill EPF Form 15G for online EPF withdrawal. # Login to EPFO UAN Unified Portal for members.

- 15G” See section 197A(1), 197A(1A) and rule 29C Declaration under section 197A (1) and section 197A (1A) to be made by an individual or a person (not being a company or firm) claiming certain incomes without deduction of tax. Name of Assessee (Declarant) 2.

- This is good news for all the EPF members who are struggling to submit form 15G for online PF withdrawal claims. Now EPF members can submit or upload their filled form 15G PDF in UAN member portal.

What is Form 15G and Form 15H?

TDS is required to be deducted under section 194A at the rate of 10% on interest other than interest on securities. If PAN is not submitted then tax is to be deducted @ 20%. Therefore, banks are also required to deduct TDS on interest payable on deposits if the interest amount exceeds Rs. 10,000 in a financial year. The bank includes deposits held in all its branches to calculate this limit.

15g Form Pdf For Pf

In order to relieve assesses who are not liable to income tax as their taxable income doesn’t exceed the basic exemption limit, form no. 15G and form no. 15H are introduced under section 197A and Rule 29C.

Form 15G or 15H can also be filed for TDS on EPF withdrawal, income form corporate bonds, post office deposits and insurance commission under section 194D. Form 15G/15H can also be filed for TDS on rent under section 194I from financial year 2016-17.

Difference between Form 15G and Form 15H

Form 15G

- Can be submitted by resident individual or HUF

- Can be submitted by person who is less than 60 years of age.

- Can be submitted only when the tax on estimated income for the year is nil

- Can be submitted only when amount of interest and other income from all sources doesn’t exceed the basic exemption limit which is Rs. 2,50,000 for financial year 2016-17 and 2017-18.

Form 15H

- Can be submitted only by resident individual who is above 60 years of age or completes 60 years during the financial year. Can not be submitted by HUF.

- Can be submitted only when the tax on estimated income for the year is nil.

- Although Form 15H can be submitted when the total income from all sources exceeds the basic exemption limit which is Rs 3,00,000 for senior citizen and Rs. 5,00,000 for super senior citizen for financial year 2016-17 and 2017-18.

Examples to understand who can submit Form 15G and Form 15H

| Income of | A | B | C | D |

| Age | 20 | 25 | 65 | 67 |

| Salary | 1,70,000 | 90,000 | 1,80,000 | 0 |

| Fixed Deposit interest income | 60,000 | 2,60,000 | 70,000 | 3,40,000 |

| Total income before deductions | 2,30,000 | 3,50,000 | 2,50,000 | 3,40,000 |

| Section 80C deductions | 0 | 1,10,000 | 0 | 1,00,000 |

| Taxable Income | 2,30,000 | 2,40,000 | 2,50,000 | 2,40,000 |

| Minimum exempt income | 2,50,000 | 2,50,000 | 3,00,000 | 3,00,000 |

| Eligible to submit Form 15G | Yes | No | Yes | Yes |

| Eligible to submit Form 15H | No | No | No | No |

| Explanation | Form 15G can be submitted as the taxable amount and income from all sources are less than Rs. 2,50,000 | Form 15G can not be submitted as the income from interest income is more than Rs. 2,50,000 | Form 15H can be submitted if age is more than 60 years and tax calculated on total income is nil. | Form 15H can be submitted if age is more than 60 years and tax calculated on total income is nil. Form can be filed even if the amount of interest is more than basic exemption limit. |

When to File Form 15G/15H?

These forms have a validity of one financial year. Therefore they are to be resubmitted in every financial years. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.

What if TDS already deducted?

If the TDS has already been deducted before submitting of form, then the only way is to file the income tax return and claim such TDS in it. The person who has deducted tax has to provide you TDS certificate in Form 16A . Also note that interest on FD is credited to your account at end of each year and not at maturity. TDS deducted in a year is to be claimed in ITR of that year only. TDS claim can not be carried forward.

Download Form 15G / Form 15H in Pdf, fillable Pdf, Word or Excel Formats

| Form 15G | Form 15H |

| Fillable PDF | Fillable PDF |

| Word | Word |

| Excel | Excel |

Filled Sample Form

Form 15G – Sample Form

Form 15H – Sample Form

Submitting Form 15G/15H online

Now a person need not fill the form manually, online facility for filing form 15g/h is now available. You just need to login in to your net banking account, download the pre-filled form, take a printout and submit it in your bank after signing.

Penalty for Filing Form 15G/15H if you are not eligible

A false or wrong declaration in Form 15G/15H attracts penalty under Section 277 of the Income Tax Act. Prosecution includes imprisonment which may range from three months to two years along with fine. The term can be extended up to seven years and with fine, where tax sought to be evaded exceeds 25 lakh.

In case a person becomes ineligible afterwards

In a case where at the beginning of year you submit 15G/15H because you meets the specified criteria and afterwards you gets unexpected income and thus not fall within specified criteria then you needs to submit a 15G/15H withdrawal application and the bank has to deduct TDS on next payment to your account.

Other Points

- If you have submitted form 15G/15H, it doesn’t means that you don’t need to submit PAN to the deductor, if you will not submit PAN then TDS is to be deducted @ 20%.

- Interest in calculated on accrual basis and not on payment or due basis.

- It is advised to take a written acknowledgement of submitting such form to avoid inconvenience.

- The payer of income is required to submit one copy of such forms to the Commissioner of Income tax on or before 7th of next month in which the form is submitted to him. Circular no. 351, dated 26th nov, 1982.

The New Form No. 15G and 15H is applicable to all Tax payees who do not want TDS Deduction on their Income from Fix deposits of Bank/company, postal fix deposit, Senior citizen Saving Scheme.

When can you submit form 15G/15H?

Lg wireless mouse driver. YouTube-Twitter-Twitter:Facebook:Google+:Empireavenue:Scanner mouse is a Mouse and scanner combo, this device allows for easy scanning of documents, using your mouse to hover over. As long as you cover the whole page. And there are no set patterns to how you have to scan the document. While holding the Smart Scan button on the left side of the mouse, the user simply swipes the mouse over the material to be scanned.

- Depositor whose tax liability is NIL can only submit the 15G/15H form.

- Depositor having interest income above basic income tax slab will not be able to submit the 15G/15H form. Suppose if any depositor has interest income of 4 lakh which is above basic slab cannot submit 15G/15H form.

- Submit 15H form if depositors age is above 60 years.

Also Read – File Form 15G and Form 15H Online and Save TDS

- One can submit form 15G/15H if interest income from particular branch of bank is above Rs.10,000/- and for company deposits its above Rs.5000/-

Download New 15G/15H forms:

New 15G/15H forms are applicable from AY 2013-14 & old forms won’t work anymore. In the new form Income Tax department has ask for additional information like e-mail ID, Mobile Number, Profession, AO Code/Ward/Circle.

Must read – 20 Types of Taxes in India

Another major change in these forms, compared to the earlier versions, is the addition of a column to mention the total estimated income from all sources, including the income for which exemption from TDS is requested.

Upload Form 15g Pdf Pf Withdrawal

Remember in order to avoid TDS you should submit Form No. 15G or 15H at the beginning of the year. In case you are late and bank has already deducted tax you have no other option but to file your income tax return and claim the amount of TDS a refund.

This form submission is valid only for 1 year and you need to submit this form again at starting of every financial year.

Please ensure to mention and submit your PAN card detail to the bank while submitting form 15 G or 15 H. In case you fail to submit PAN card detail bank will deduct TDS @20%.

Pf Form 15g Pdf Download

Don’t forget to take acknowledgement of this form submission from the bank.

Also Read – 15 High Value Transactions tracked by Income Tax

If your tax liability is NIL please submit form 15G/15H to avoid TDS.

Click on following image to download form 15G/15H

Pf Withdrawal Form 15g Pdf

Download Form 15G pdf form

Pf Form 15g Pdf Download

Download Form 15H pdf form